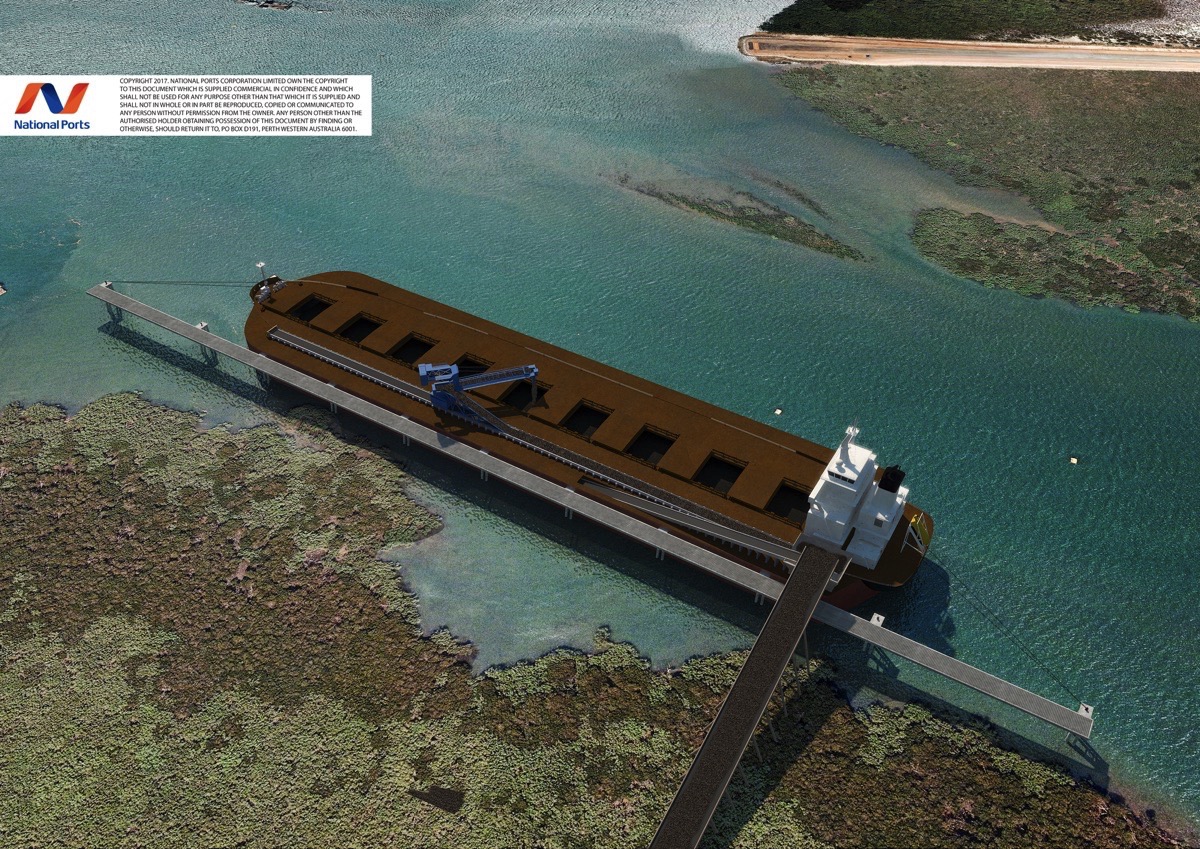

The Transmax is a 190,000 dwt bulk carrier on 14 m draft (the existing capacity on the same draft is 120,000 dwt). Each self-propelled Transmax will be designed to match the depths of water available at each port, for example, a 60,000 dwt Transmax can transit a port with water depths of only 6.5 m.The Transmax is equipped with innovative cargo handling systems designed and built by thyssenkrupp Industrial Solutions, capable to self-unload its cargo into any size ocean going vessel at rates of up to 10,000 tph compares with prevailing technologies with a maximum unloading rate of 3,000 to 5,000 tph

The Transmax can be loaded at existing berths using existing ship-loaders or can be loaded directly from a shore conveyor avoiding the capital cost for a conventional marine berth and travelling ship-loaders. This represents a substantial saving in capital expenditure.The Transmax is able to self-unloading cargo from any size bulk carrier and is a solution for draft restricted ports worldwide.

Limited draft is a World-Wide Problem

The vast majority of global export ports are geographically remote and not sufficiently dredged to handle modern bulk carriers, and majority of import ports suffer the same difficulty.While capesize bulk carriers require a draft of about 19 m including clearance under the keel, most ports have a draft of 14 m or less, e.g Australia, India, Brazil, Africa and Middle Eastern countries. These draft limitations constrain exports and imports.Dredging is very expensive and this cost increases exponentially when dredging hard materials, particularly in rock. Furthermore, environmental requirements/regulations are far reaching and challenging.

Examples of Countries with challenging Export/Import

- Australia (Port Hedland)The average vessel loading iron ore at Port Hedland is 180,000 dwt on 18.2 m draft. Port Hedland’s inner harbour and channel have a draft of 14.3 m at low tide. Laden cape size ships can only depart the inner harbour at high tide.According to the Pilbara Ports Authority, the maximum throughput capacity of the port is 577 million tonnes per year. This will be reached in approximately 3 years.The Pilbara Port Authority does not have a solution on how to increase the port throughput at Port Hedland beyond 577 million tonnes per year.The self-propelled Transmax opens (24/7) the draft limited port of Port Hedland to far greater tonnages with no dredging, capital expenditure, or change to materials handling process or equipment.

- IndiaWith the exception of three ports, “In India none of the 12 ports owned by the Indian Government can handle capesize ships at their berths because of lack of adequate depth, which average 13 m...”Currently “Capesize ships loaded with coal would anchor in the mid-sea, some 31 nautical miles from Kandla. From there, floating cranes would unload the cargo into 2,000 t barges that are taken to the port.”This is a very inefficient and expensive processThe Transmax will self-load the full cargo (180,000 t) from the capesize ships at anchor and self-unload it at the port of destination at the rate of up to 10,000 tph.

- BrazilThe distance from Brazil to the markets of China, Japan, Korea, and other South East Asian countries, is about three times more than its Australian competitors. This represents a major additional shipping cost.To mitigate the challenge of the extra distance in an effort to reduce the freight costs and allow Vale to compete with the Australian producers, Vale has built a fleet of very large bulk carriers (400,000 dwt “Valemax”) Very few ports in China, Japan, Korea or other world countries can accommodate these 400,000 dwt vessels

Limited Port Accessibility constrains Exports

By positioning the self-propelled Transmax in deep water near the port of destination, Vale can deliver its bulk commodities with its Valemax ships directly to any port in the world.The Transmax can self-unload the full cargo from the 400,000 dwt vessel and self-discharge it directly at the port of destination at the rate of up to 10,000 tonnes per hour.

The Transmax can be chartered on a Per-Tonne Basis

National Ports will be responsible for all operating and ports costs.The Transhipment cost per tonne will be off-set by the following saving:

- For exporting ports such as Port Hedland, the ocean going vessel will no longer enter the inner harbour, therefore the port cost will be massively reduced

- Export/imports can now be undertaken by larger ocean going bulk carriers, therefore the freight cost per tonne will be far less

- In some cases because of tide restriction, the ocean going vessel currently depart the berth NOT fully loaded, by operating the Transmax, the dead freight cost is removed

- Reduction of demurrage cost

The effective net result is that the client will be able to increase the cargo throughput at almost zero cost. ■