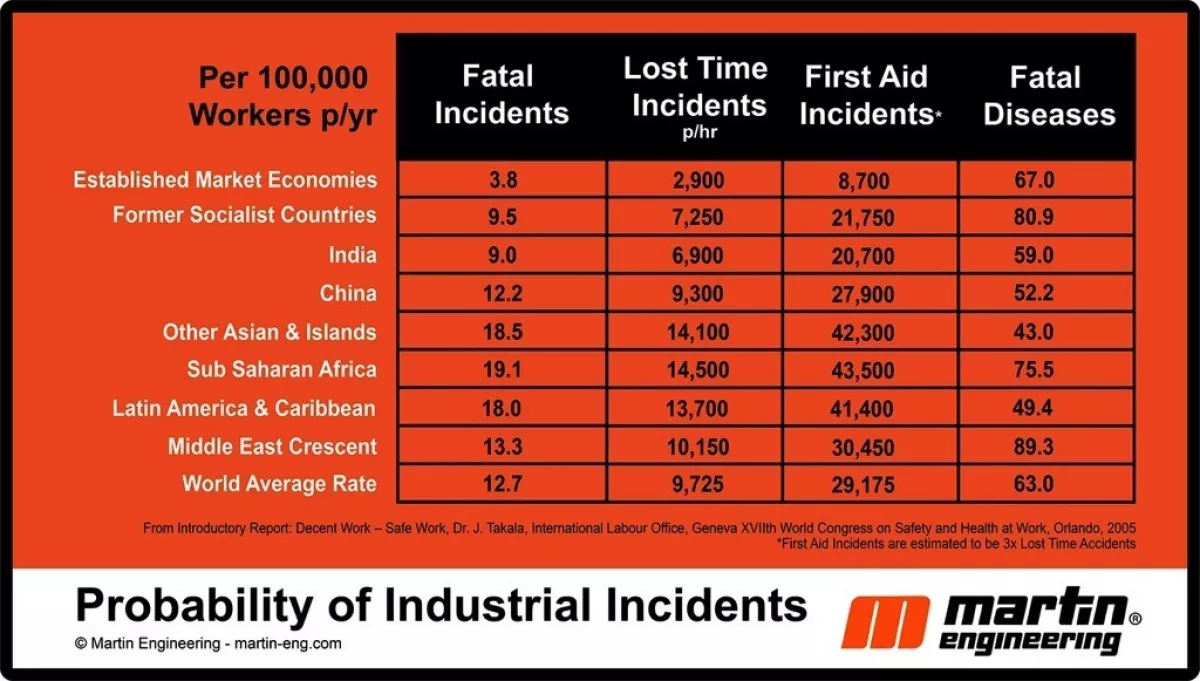

Lacking specific historical data, managers can turn to numerous reliable sources that provide the probability of incidents that can be used to estimate tangible and intangible future costs.

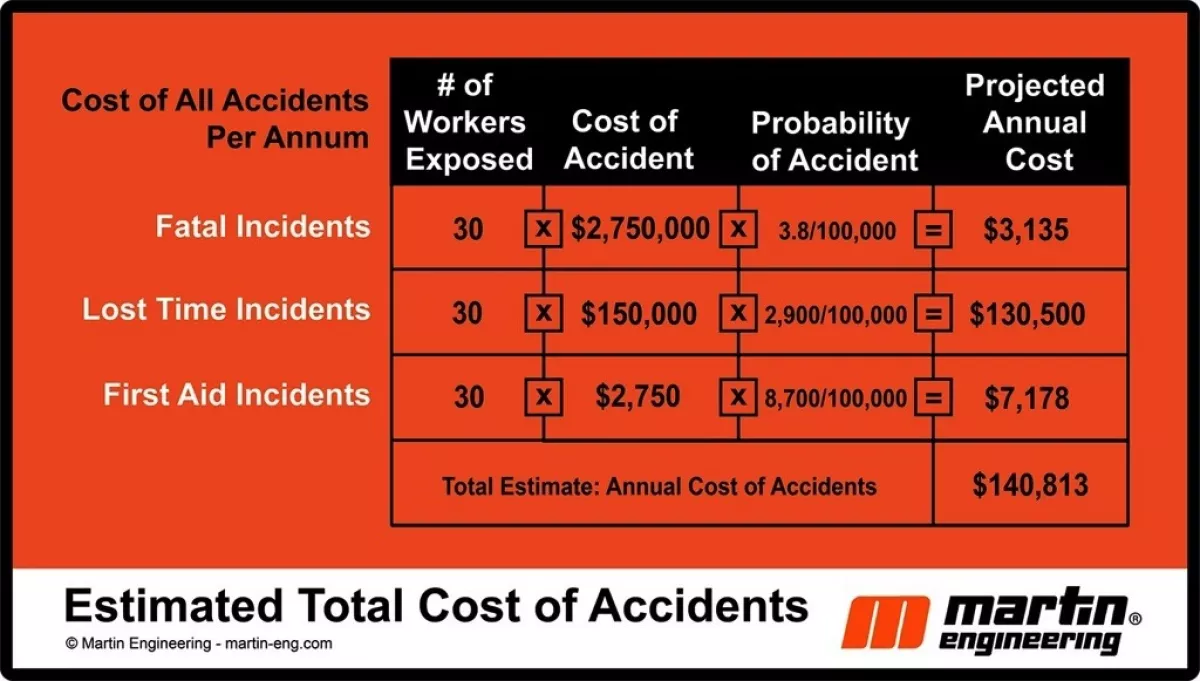

The financial technique used to compare options is called a “net present value” (NPV) analysis. NPV compares different investment options with varying costs and savings (cash flows) over time, discounting them by the company’s cost of money. For example, an internal risk analysis shows a facility has 30 workers exposed to conveyor hazards. The estimated probability of the different classes of accidents (fatal, lost time and first aid) is multiplied by the cost of these accidents to reveal what could be invested to reduce the incident rate by half.

Assuming the life of the conveyor is 20 years and the cost of money (discount rate) is 5 percent, the available additional investment would be about $750,000 more in design time to accomplish the 50% improvement in safety. By choosing the lowest-priced bid to meet the minimum safety requirements, the short-term expenditure ends up costing considerably more over the 20-year lifecycle.

By spending $750,000 more to exceed the minimum safety and design requirements and reduce the accident rates by 50%, the annual projected cost of accidents drops from $140,813 to $70,407.

Measured in today’s dollars — including the additional investment of $750,000 – the projected savings over the 20-year term at 5% are about $1.2 million by investing more upfront. If, after further analysis, the savings are found to be less – perhaps only a 25% reduction in the cost of accidents – the upfront investment is still justified over the long term. Even though it takes a little more effort to collect data and do a financial analysis, in the end, NPV consistently proves that safety does indeed pay.